What Is a Self-Insured Plan?

A Complete Guide for Employers

In this competitive business environment, managing healthcare costs while providing quality benefits to employees is a top priority for employers. One strategy that’s on the rise is the adoption of

self-insured plans, also known as self-funded health plans. But what exactly is a self-insured plan, and is it the right choice for your organization?

In this blog, we’ll dive deep into the concept, explore its pros and cons, and provide actionable insights to help you decide if this approach aligns with your business goals.

What Is a Self-Insured Plan?

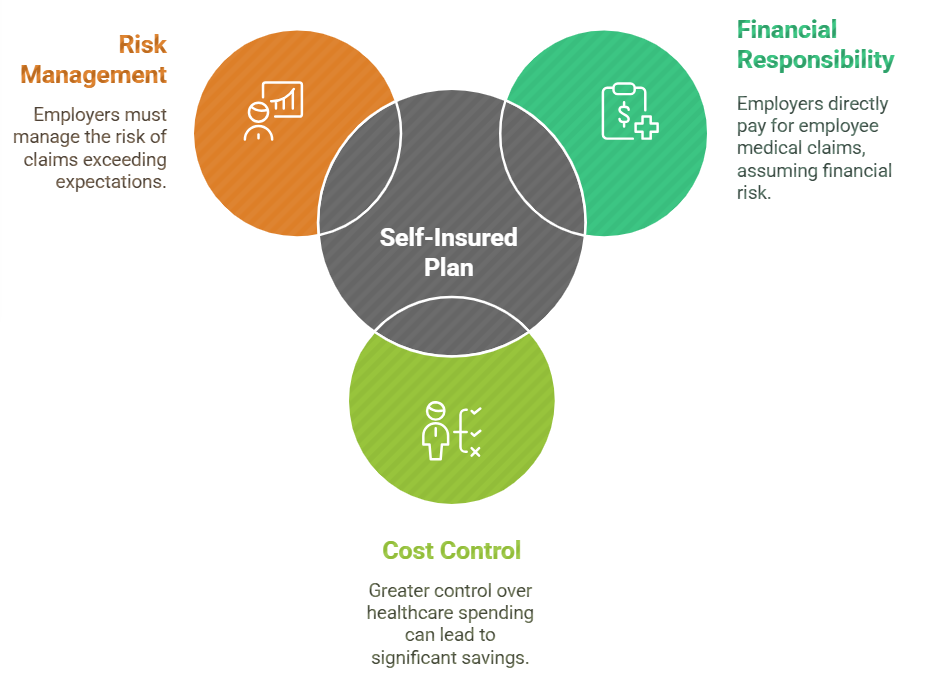

A self-insured plan is a healthcare model where the employer takes on the financial responsibility of providing health benefits to employees, rather than purchasing a traditional fully insured plan from an insurance carrier. Instead of paying fixed premiums to an insurance company, the employer pays for medical claims directly as they arise. This model gives employers greater control over their healthcare spending and can lead to significant cost savings—if managed effectively.

Think of it this way: with a fully insured plan, you’re paying a set premium to an insurance company, and they handle everything. With a self-insured plan, you’re cutting out the middleman and taking charge of your healthcare dollars. But with this control comes responsibility—you’re also assuming the financial risk if claims exceed expectations.

How Does a Self-Insured Plan Work?

At its core, a self-insured plan shifts the financial risk from an insurance carrier to the employer. Here’s how it typically works:

- Employer Pays Claims Directly: Instead of paying premiums to an insurer, the employer sets aside funds to cover employees’ medical expenses. These funds are used to pay claims as they come in.

- Stop-Loss Insurance: To protect against unexpectedly high claims, most employers purchase stop-loss insurance. This acts as a safety net, kicking in when claims exceed a predetermined threshold. It’s like an insurance policy for your insurance plan.

- Third-Party Administrators (TPAs): While the employer assumes the financial risk, they often hire a third-party administrator (TPA) to handle the day-to-day operations—claims processing, network management, compliance, and more. This allows employers to focus on their business while leaving the administrative heavy lifting to the experts.

- Customizable Benefits: One of the biggest perks of self-insured plans is the flexibility to design a benefits package tailored to your workforce. You’re not locked into a one-size-fits-all plan; you can create something that truly meets the needs of your employees.

Key Features of Self-Insured Plans

- Risk Retention: The employer retains the financial risk associated with medical claims. This means they’re responsible for paying out-of-pocket for any medical expenses incurred by employees.

- Cost Management: Self-insured plans can lead to lower overall costs because employers avoid paying the profit margins and administrative fees that insurance companies typically charge. Employers only pay for actual claims incurred, which can provide cash flow advantages.

- Flexible Plan Design: Organizations have the flexibility to design their health benefits according to their specific needs and those of their employees, rather than adhering to pre-packaged options offered by insurers.

- Stop-Loss Insurance: To mitigate the risk of catastrophic claims, many self-insured plans purchase stop-loss insurance. This coverage kicks in when claims exceed a certain threshold, protecting the employer from excessive financial exposure.

- Third-Party Administration (TPA): While employers assume the financial risk, they often engage third-party administrators to handle plan operations such as claims processing, provider network management, and compliance with regulations. This allows employers to leverage expertise without having to build it in-house.

Advantages of Self-Insured Plans

Self-insured plans offer several benefits that can make them an attractive option for employers:

- Cost Savings: By avoiding premium payments to an insurance company, employers can save on costs associated with administrative fees and profit margins. Additionally, they can benefit from cash flow advantages by only paying for claims as they arise.

- Customization: Employers can tailor their health plans to better meet the needs of their workforce, offering unique benefits that may not be available through traditional insurance plans.

- Regulatory Flexibility: Self-insured plans are generally subject to fewer state regulations compared to fully insured plans, which can reduce compliance burdens and costs.

- Potential Refunds: At the end of the plan year, if there are surplus funds remaining in the plan due to lower-than-expected claims, these funds may be returned to the employer.

Disadvantages of Self-Insured Plans

Despite their advantages, self-insured plans also come with certain risks and challenges:

- Financial Risk: Employers must be prepared for the possibility of high claims costs that could exceed their expectations. This is particularly concerning for smaller organizations with fewer resources to absorb unexpected expenses.

- Administrative Burden: Managing a self-insured plan requires significant administrative effort and expertise. Employers must either develop this capability internally or rely on third-party administrators, which can incur additional costs.

- Cash Flow Management: Organizations must maintain sufficient cash reserves to cover potential claims, which can be challenging for some employers.

Key Considerations Before Choosing a Self-Insured Plan

Before deciding on a self-insured plan, employers should consider several factors:

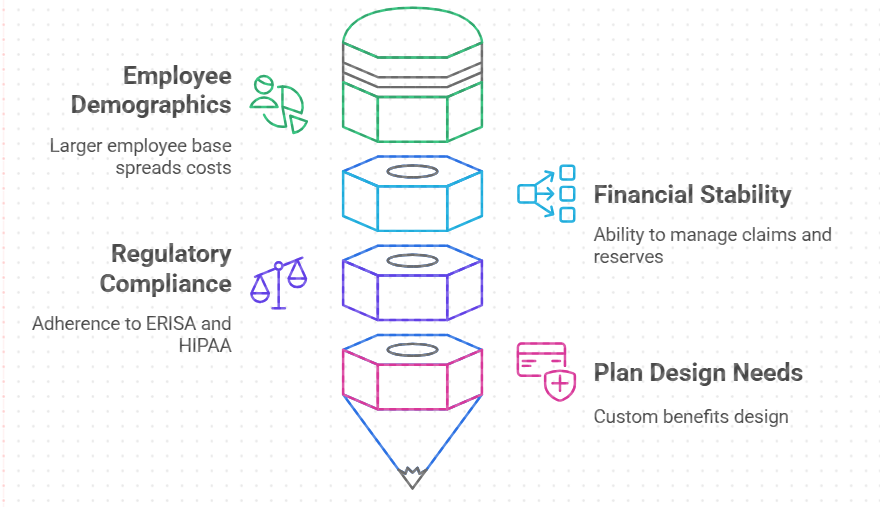

- Employee Demographics: Organizations with a larger employee base may find self-insurance more viable due to a broader risk pool that helps spread out potential costs.

- Financial Stability: Employers should assess their financial capacity to manage potential claims and maintain adequate cash reserves for unexpected medical expenses.

- Regulatory Compliance: Understanding applicable regulations is crucial since self-funded plans are subject to different laws compared to fully insured plans. Employers must ensure compliance with federal regulations such as ERISA (Employee Retirement Income Security Act) and HIPAA (Health Insurance Portability and Accountability Act).

- Plan Design Needs: Employers should evaluate whether they have specific benefit design requirements that would be better served by a self-insured model rather than a fully insured one.

Conclusion

Self-insured health plans represent a Forward approach for employers looking to gain control over their healthcare expenses while providing tailored benefits to employees. While they offer many advantages such as cost savings, flexibility, and regulatory ease, they also come with risks that require careful consideration and planning.